ABC Bullion’s Chief Economist Jordan Eliseo provides his insights from the SMSF Association National Conference last week on the growth in physical bullion investment and why trustees are buying bullion.

The SMSF Association National Conference last week was well attended by more than 1,000 financial advisers, accountants, auditors and service providers. The conference is the largest annual gathering for professionals servicing the $600 billion Self-Managed Superannuation Fund market in Australia and featured an impressive list of key note speakers, including our Federal Treasurer, the honourable Scott Morrison.

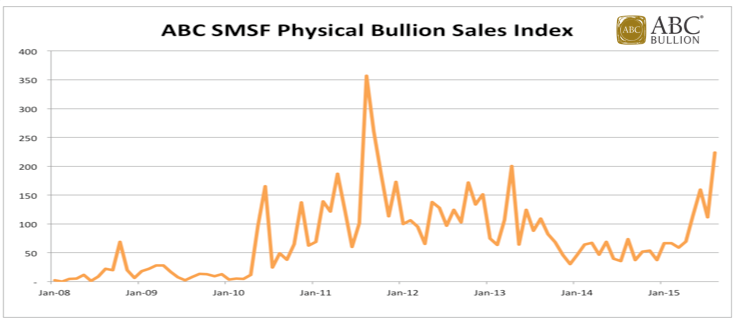

Over the past decade ABC Bullion has witnessed first-hand the growth in physical bullion investment that has come from the SMSF community. Indeed turnover to SMSF clients buying bullion is running at nearly the fastest rate on record, according to the ABC Bullion SMSF Physical Bullion Sales Index.

The first two months of 2016 have seen a continuation of this trend, with a sharp fall in equity markets, and a gold price heading well above AUD $1600 per ounce stimulating demand for the precious metals.

Not surprisingly, there has been a lot of interest from accountants and advisors who attended the conference, with many commenting they were now personally looking at precious metal investment, and they had clients who were also increasingly interested in securing an allocation to physical gold and silver.

Why are trustees buying bullion?

Talking to SMSF trustees and professionals at the conference, there were four main reasons trustees are turning to gold and silver.

- Low interest rates: SMSF trustees often hold 25-30% and in some cases more of their portfolios in cash and term deposits. With interest rates at record lows, many are turning to gold, as it has a history of outperformance when ‘real’ interest rates (calculated by subtracting the inflation rate from the RBA cash rate) are at 2% or less, like they are today.

- Diversification from the stock market: SMSF trustees also tend to hold sizeable allocations to Australian shares, including our major banks, supermarkets and telecommunications companies. Gold is uncorrelated to the stock market, and has historically been the best performing asset in the months and quarters when the stock exchange falls the most. As such, owning gold alongside these blue chip shares helps balance out a total portfolio.

- Foreign Exchange Position: As gold is priced in US Dollars, it is a natural foreign currency exposure in an Australian portfolio. Many SMSF trustees have portfolios that are mostly comprised of Australian dollar investments, so by buying gold, they get some overseas exposure in their portfolio, and will benefit from any fall in the Australian dollar in the coming years.

- Liquidity and tangibility: A final factor that is increasingly attractive to SMSF trustees is the tangibility of gold, and the fact it is so liquid and easy to trade. Many trustees are rightly concerned about investing in products that are opaque, and difficult to liquidate. Gold can be bought and sold 24 hours a day, making it an easy market for trustees to enter and exit as they see fit.

The decision to incorporate gold and silver into their portfolio has been a major benefit to trustees who’ve chosen to do so, with precious metals outperforming all liquid assets over the past 10 years, as well as reducing portfolio risk.

Will turnover continue to grow?

Whilst one can never be certain where gold prices, and where gold demand are headed, we think there are a number of tailwinds which will support the sector in the coming years.

These include the zero to negative real interest rates on offer in developed market economies the world over, as well as the historically low yields on traditional defensive assets like government bonds.

Risks to equity markets, and the global economy itself are also likely to drive demand toward ‘safe haven’ investments like gold, whilst any acceleration in the ‘currency wars’, and further monetary debasement in Japan, Europe and the like will also see gold once again become a savings currency of choice.

The role of physical gold and silver in truly diversified investment portfolios will likely grow as these trends play out over the coming years. This reinforces the importance of the Gold Industry Group, and the role of members to profile and promote the importance of gold investment to the broader investment community.

It also highlights the benefit of engaging with industry leading bodies in Australia’s superannuation and wealth management sector, including the SMSF Association.