Written by ABC Bullion Chief Economist and Gold Industry Group Project Subcommittee member Jordan Eliseo.

Discover the eight reasons why Australian investors should consider including physical gold in their investment portfolio. Here is number three.

3. Gold is uncorrelated with risk assets

When we talk about the correlation in prices for assets traded in financial markets we are referring to how closely those prices mimic each other.

Highly correlated assets tend to move in the same direction most of the time. A good example is the shares in our four major banks, which tend to move in unison most days, unless there is some news (either good or bad) that only affects one of the companies.

One of the advantages of gold is that it is uncorrelated to the stock market, unlike commodities prices as a whole, which tend to be positively correlated to the stock market.

There are countless examples looking at the USD price return for gold, commodities and stocks which highlight the above fact, but the same can be said when we look at the correlation of physical gold priced in Australian Dollars with the Australian stock market.

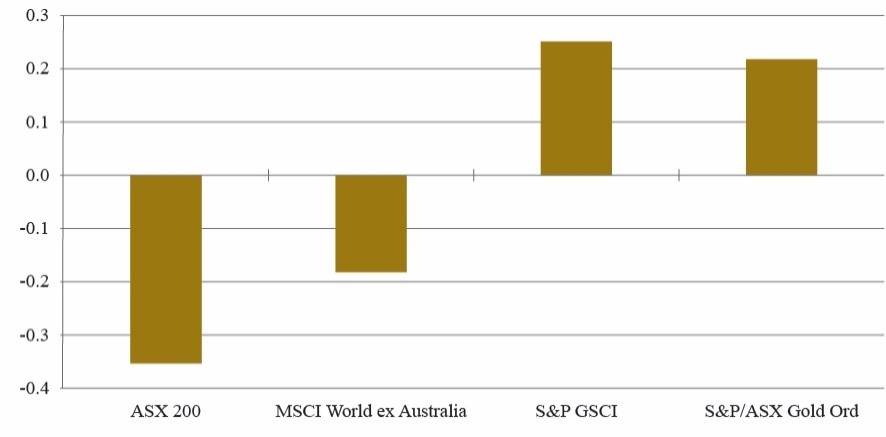

The World Gold Council publishes investment statistics looking at gold in a range of currencies, including Australian dollars. It found that the weekly return correlation (for a five-year period ending September 2013) between physical gold in AUD and the Australian equity market over the time-period studied was -0.35, whilst the correlation between gold in Australian dollars and the MSCI World ex-Australia was -0.19.

Figure 1: Correlation of Weekly Returns: Gold vs. Other Assets

Source: World Gold Council, ABC Bullion

Physical gold in Australian dollars also only had a correlation of 0.21 with the S&P ASX Gold shares index (see chart to the right).

This low correlation between gold and traditional risk assets such as shares helps smooth out portfolio returns over time, which is always a benefit for investors.

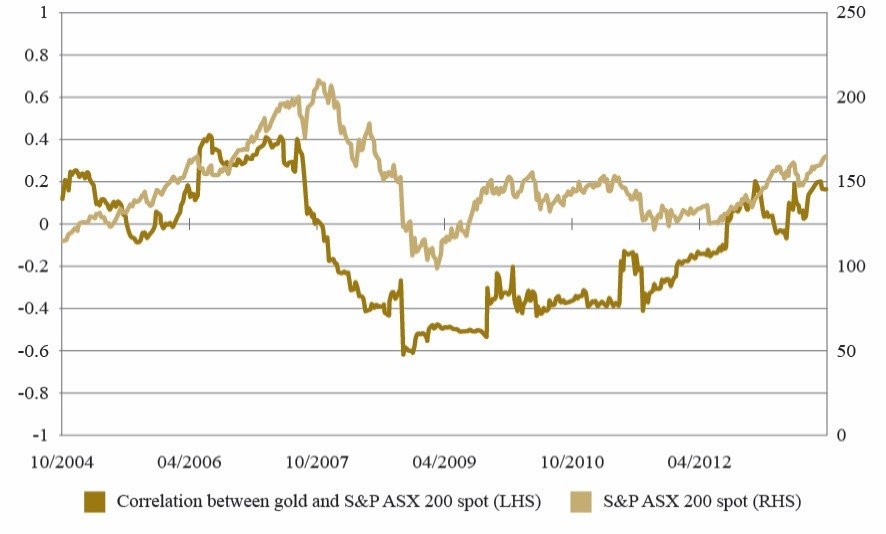

Figure 2: Correlation of Returns: ASX and Gold over Rolling 52 Week periods

Source: Bloomberg, World Gold Council

But what is arguably even more important for Australian investors is what happens during periods of heightened market volatility, when the share market suffers its largest falls. As per the chart to the right, which also comes from the WGC study, you can see that the correlation between physical gold in Australian dollars and the local equity markets turns sharply negative when the ASX is selling off.

Indeed, during the height of the Global Financial Crisis, as equity markets the world over were plunging to their lows, the correlation between physical gold in AUD and the ASX200 fell all the way to -0.60.

While shares were sinking, gold was rallying, and rallying hard.

Like a good insurance policy, gold tends to pay out almost exactly when an investor needs it to. This highlights one of the main reasons why a physical gold position can play a strategic role within a well-balanced Australian investment portfolio, as it will help smooth out returns for any investor with a healthy allocation to ASX listed stocks.

It is also worth pointing out that, due to the fact it is lowly or even negatively correlated with risk assets such as shares, the benefits of owning physical gold are not limited to GFC-style events like the one observed in the chart above.

Correlation analysis using annual return data from 1971 to the end of 2014 inclusive proves this point. Over this more than four-decade time-period, in the years in which the equity market rose, physical gold returns had a positive, but relatively low, correlation of 0.17 with the Australian equity market. When the local stock market had a negative annual return, however, the correlation between physical gold priced in Australian dollars and the Australian equity market was -0.59.

The end result was that any Australian investor who had been disciplined enough to maintain a core gold position in their portfolio was able to better protect their overall investments during the more volatile years the ASX has gone through in the past, and will almost certainly go through again in the future.

Whilst we can’t be certain what will transpire in the years ahead, over forty five years of market history demonstrates clearly that Australian investors will most likely experience lower overall portfolio volatility by maintaining a strategic gold holding.